Strong fourth quarter to close 2025, momentum continuing into 2026

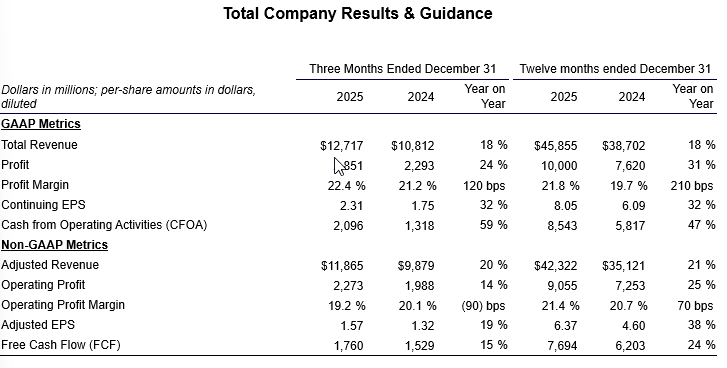

Fourth Quarter 2025:

- Total orders of $27.0B, +74%;

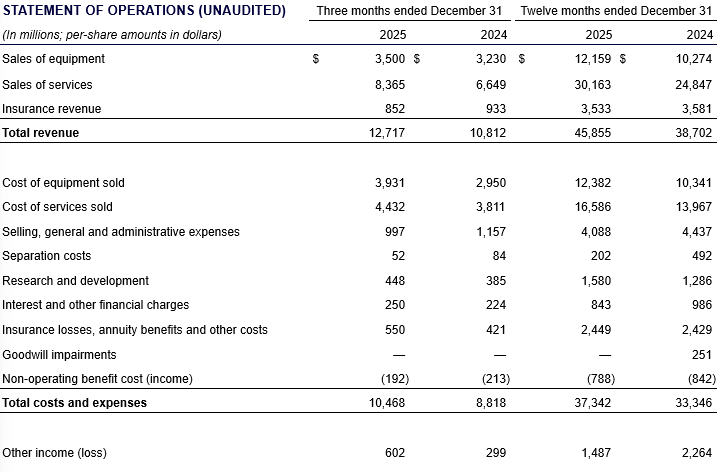

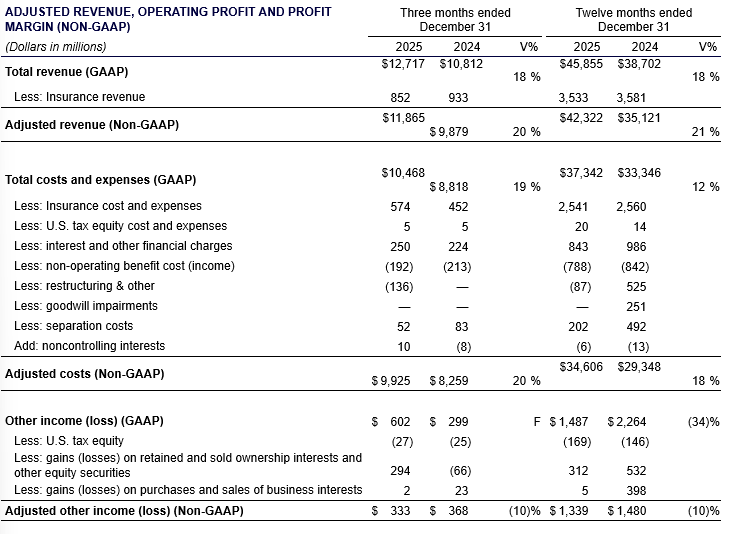

- Total revenue (GAAP) of $12.7B, +18%; adjusted revenue* $11.9B, +20%;

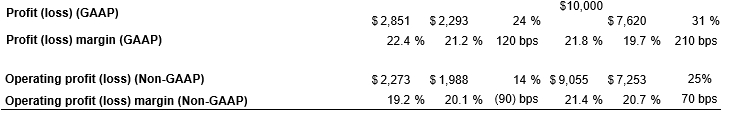

- Profit (GAAP) of $2.9B, +24%; operating profit* $2.3B, +14%;

- Profit Margin (GAAP) of 22.4%, +120 bps; operating profit margin* 19.2%, (90) bps;

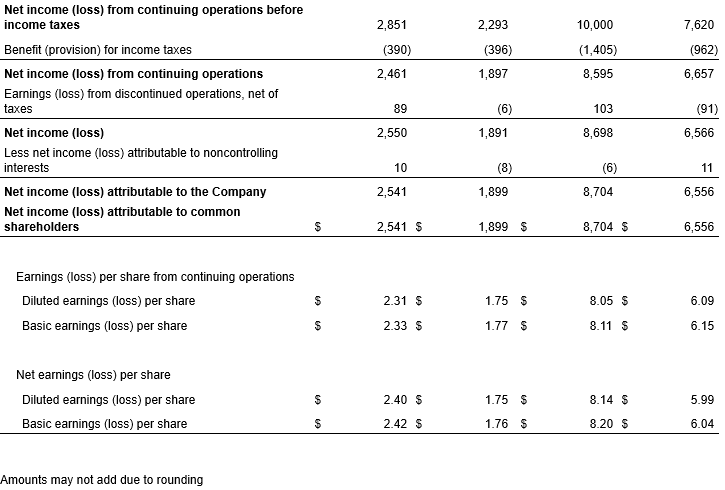

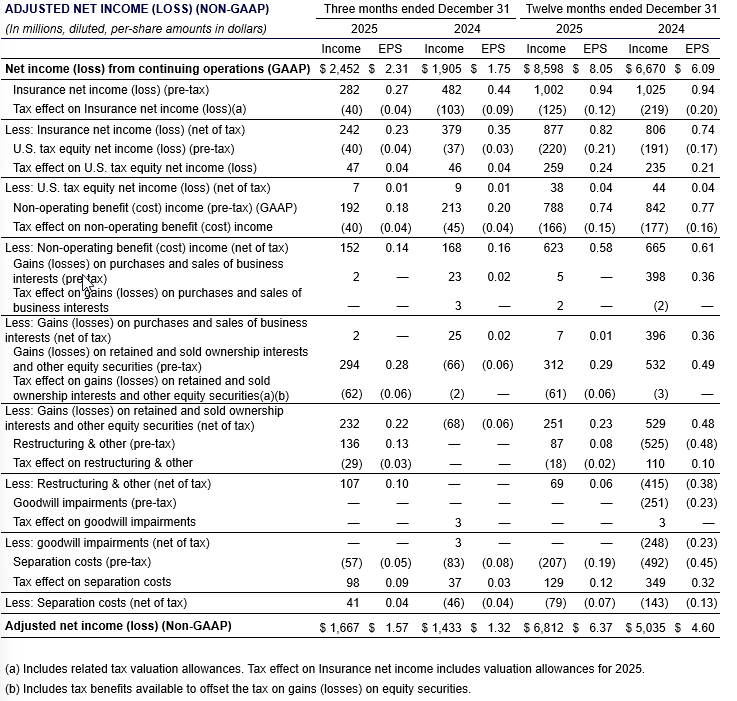

- Continuing EPS (GAAP) of $2.31, +32%; adjusted EPS* $1.57, +19%;

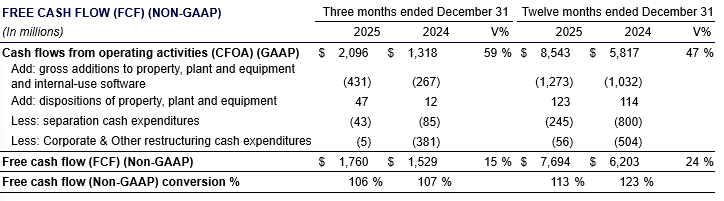

- Cash from operating activities (GAAP) of $2.1B, +59%; free cash flow* $1.8B, +15%

Full year 2025:

- Total orders of $66.2B, +32%;

- Total revenue (GAAP) of $45.9B, +18%; adjusted revenue* $42.3B, +21%;

- Profit (GAAP) of $10.0B, +31%; operating profit* $9.1B, +25%;

- Profit Margin (GAAP) of 21.8%, +210 bps; operating profit margin* 21.4%, +70 bps;

- Continuing EPS (GAAP) of $8.05, +32%; adjusted EPS* $6.37, +38%;

- Cash from operating activities (GAAP) of $8.5B, +47%; free cash flow* $7.7B, +24%

CINCINNATI — January 22, 2026 — GE Aerospace (NYSE:GE) announced results today for the fourth quarter and full year ending December 31, 2025.

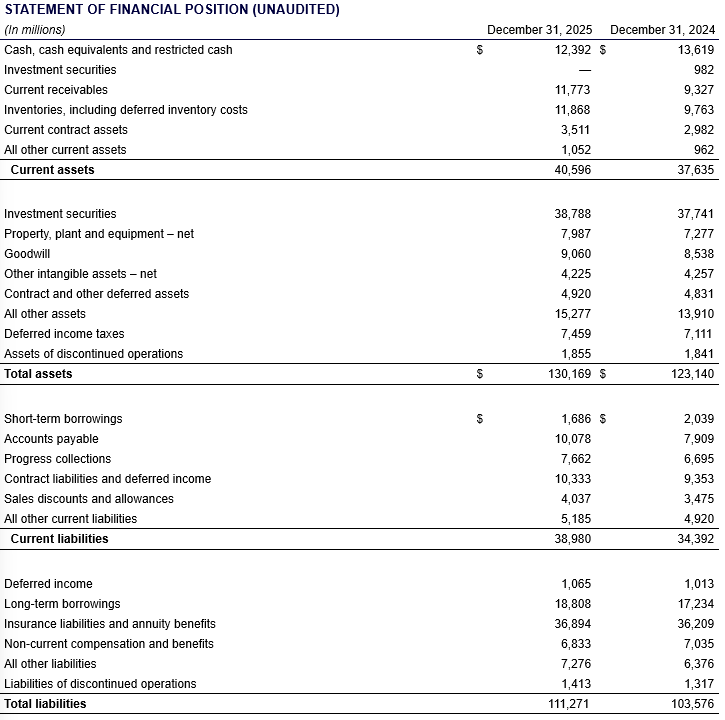

GE Aerospace Chairman and CEO H. Lawrence Culp, Jr., said, “With a strong fourth quarter, GE Aerospace delivered an outstanding year as revenue grew 21%, EPS was up 38%, and free cash flow conversion exceeded 100%. Our performance demonstrates how FLIGHT DECK is taking hold as we accelerated services and equipment output to fulfill our growing backlog of roughly $190 billion."

Culp continued, "We enter 2026 with solid momentum to build upon these results and are well positioned to create greater value for our customers. This supports another year of substantial EPS and cash growth, and I'm confident our team will deliver."

Recent highlights include:

- Expanded Commercial Engines & Services (CES) to include Technology & Operations (T&O) and be led by Mohamed Ali. Created Commercial Sales & Customer Experience, led by Jason Tonich, elevating customer-driven focus.

- Increased material input from priority suppliers more than 40% year-over-year in 2025. This contributed to full-year CES services revenue up 26% and engine deliveries increasing 25% year-over-year, including record LEAP deliveries up 28%. Full-year Defense deliveries were up 30% year-over-year.

- Received over 500 engine wins at the Dubai Airshow including commitments from Riyadh Air for 120 LEAP-1A engines and flydubai for 60 GEnx engines. Also progressed future of flight technologies by launching the company's first ground tests of a hybrid electric demonstrator.

- Investing more than $1 billion across global Maintenance, Repair and Overhaul (MRO) network, including half billion dollar investment for LEAP capacity in Brazil, Malaysia, Dubai, Dallas and other sites.

- Renewed agreement between CFM International and International Air Transport Association (IATA), which affirms CFM's commitment to an open aftermarket for CFM56 and LEAP.

- Secured a new order with Hindustan Aeronautics for 113 F404 engines, successfully completed altitude testing of the GEK800 engine to power affordable unmanned platforms and Collaborative Combat Aircraft, and announced a collaboration with Shield AI to power next-gen autonomous systems with the F110.

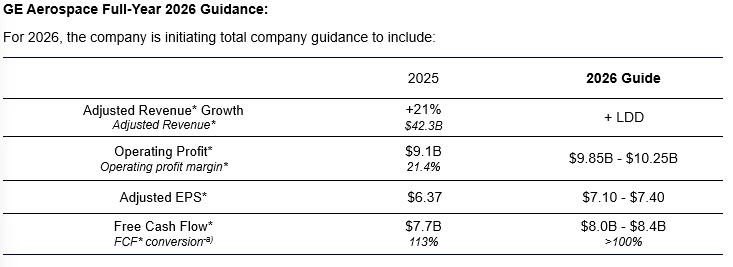

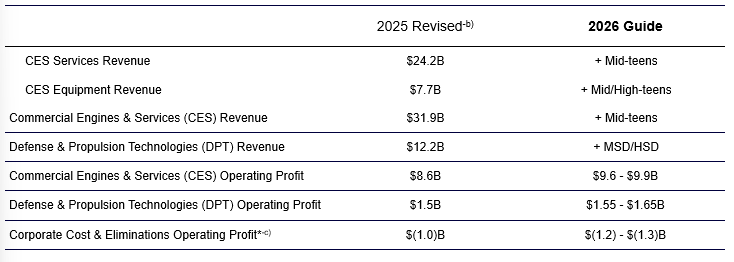

Full-Year 2026 Segment Guidance:

With the recently announced organizational changes, we are updating our segment reporting to reflect this new structure. This includes the Aeroderivative business moving from CES to DPT, and transitioning remaining T&O site revenue and cost from Corporate to their respective businesses. The following table reflects these updates:

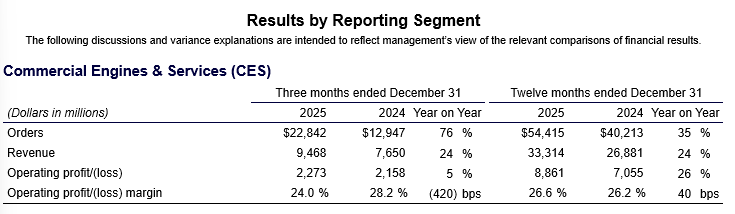

For the quarter, orders of $22.8 billion increased 76%, with services increasing 18% and equipment more than doubling. Revenue of $9.5 billion was up 24%. Services grew 31% with internal shop visit revenue up 30% from higher volume and workscopes. Spare parts revenue was up more than 25% as improved material availability supported increased output. Equipment revenue grew 7%, with unit volume up 40%, more than offsetting a year-over-year decline in the spare engine ratio. Profit of $2.3 billion was up 5%. Margins contracted (420) basis points, as Services volume and price were offset by lower spare engine ratio, higher install deliveries, including GE9X, and an increase in R&D.

For the year, CES orders were up 35%, revenue increased 24%, and operating profit grew 26% to $8.9 billion, with margins expanding 40 basis points.

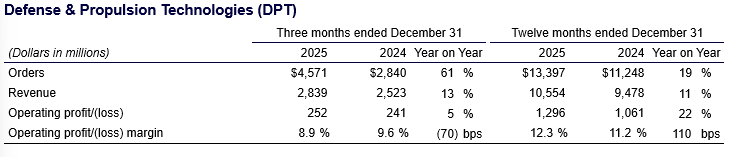

For the quarter, orders of $4.6 billion were up 61%. Revenue of $2.8 billion grew 13%. Defense & Systems revenue grew 2% as price and customer mix more than offset deliveries down by 7%. Propulsion & Additive Technologies revenue grew 33% led by higher volume at Avio Aero. Profit of $252 million was up 5% and margins were down (70) basis points as volume, customer mix, and price were offset by investments and inflation.

For the year, DPT orders were up 19%, revenue increased 11%, and operating profit grew 22% to $1.3 billion, with margins expanding 110 basis points.

Financial Measures That Supplement GAAP

We believe that presenting non-GAAP financial measures provides management and investors useful measures to evaluate performance and trends of the total company and its businesses. This includes adjustments in recent periods to GAAP financial measures to increase period-to-period comparability following actions to strengthen our overall financial position and how we manage our business.

In addition, management recognizes that certain non-GAAP terms may be interpreted differently by other companies under different circumstances. In various sections of this report we have made reference to the following non-GAAP financial measures in describing our (1) revenue, specifically Adjusted revenue, (2) profit, specifically Operating profit and Operating profit margin; Adjusted net income (loss) and Adjusted earnings (loss) per share (EPS), (3) cash flows, specifically free cash flow (FCF), (4) costs, specifically Adjusted Corporate and other operating costs reflecting updated segment structure and (5) guidance, specifically 2026 Operating profit, 2026 Adjusted EPS, 2026 Adjusted Corporate and other operating costs and 2026 FCF.

The reasons we use these non-GAAP financial measures and the reconciliations to their most directly comparable GAAP financial measures follow. Certain columns, rows or percentages within these reconciliations may not add or recalculate due to the use of rounded numbers. Totals and percentages presented are calculated from the underlying numbers in millions.

Beginning in the first quarter of 2025, we changed the terminology used to report our GAAP earnings from “Earnings” to “Net income” and our non-GAAP earnings from "Adjusted earnings" to "Adjusted net income." The change in terminology does not impact the amounts reported in the financial statements.

We believe that adjusting revenue provides management and investors with a more complete understanding of underlying operating results and trends of established, ongoing operations by excluding the effect of revenue from our run-off insurance operations. We believe that adjusting profit to exclude the effects of items that are not closely associated with ongoing operations provides management and investors with a meaningful measure that increases the period-to-period comparability. Gains (losses) and restructuring and other items are impacted by the timing and magnitude of gains associated with dispositions, and the timing and magnitude of costs associated with restructuring and other activities. We also use Adjusted revenue* and Operating profit* as performance metrics at the company level for our annual executive incentive plan for 2025.

Earnings-per-share amounts are computed independently. As a result, the sum of per-share amounts may not equal the total.

We believe that Adjusted net income* provides management and investors with useful measures to evaluate the performance of the total company and increased period-to-period comparability, as well as a more complete understanding of underlying operating results and trends of established, ongoing operations by excluding items that are not closely related with ongoing operations. We also use Adjusted EPS* as a performance metric at the company level for our performance stock units granted in 2025.

We believe investors may find it useful to compare free cash flow* performance without the effects of separation cash expenditures and Corporate & Other restructuring cash expenditures (associated with the separation-related program announced in the fourth quarter of 2022). In addition, beginning in the third quarter of 2025, we now include dispositions of property, plant and equipment. We believe this measure will better allow management and investors to evaluate the capacity of our operations to generate free cash flow*. We also use FCF* as a performance metric at the company level for our annual executive incentive plan and performance stock units granted in 2025.

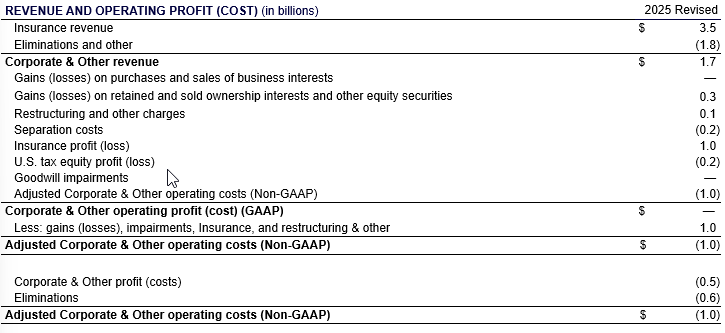

Adjusted Corporate & Other operating costs* excludes gains (losses) on purchases and sales of business interests, gains (losses) on retained and sold ownership interests and other equity securities, higher-cost restructuring programs, separation costs, our run-off insurance operations, U.S. tax equity profit (loss) and goodwill impairments. We believe that adjusting Corporate & Other costs to exclude the effects of items that are not closely associated with ongoing operations provides management and investors with a meaningful measure that increases the period-to-period comparability of our ongoing corporate costs.

2026 GUIDANCE: 2026 OPERATING PROFIT (NON-GAAP)

We cannot provide a reconciliation of the differences between the non-GAAP expectations and corresponding GAAP measure for Operating profit* in 2026 without unreasonable effort due to the uncertainty of timing of any gains or losses related to acquisitions & dispositions, the timing and magnitude of the financial impact related to the mark-to-market of our investment in BETA Technologies, Inc. and the timing and magnitude of restructuring expenses. Although we have attempted to estimate the amount of gains and restructuring charges for the purpose of explaining the probable significance of these components, this calculation involves a number of unknown variables, resulting in a GAAP range that we believe is too large and variable to be meaningful.

2026 GUIDANCE: 2026 ADJUSTED EPS (NON-GAAP)

We cannot provide a reconciliation of the differences between the non-GAAP expectations and corresponding GAAP measure for Adjusted EPS* in 2026 without unreasonable effort due to the uncertainty of timing of any gains or losses related to acquisitions & dispositions, the timing and magnitude of the financial impact related to the mark-to-market of our investment in BETA Technologies, Inc. and the timing and magnitude of restructuring expenses. Although we have attempted to estimate the amount of gains and restructuring charges for the purpose of explaining the probable significance of these components, this calculation involves a number of unknown variables, resulting in a GAAP range that we believe is too large and variable to be meaningful.

2026 GUIDANCE: 2026 ADJUSTED CORPORATE AND OTHER OPERATING COSTS (NON-GAAP)

We cannot provide a reconciliation of the differences between the non-GAAP expectations and corresponding GAAP measure for Adjusted Corporate and other operating costs* in 2026 without unreasonable effort due to the uncertainty of timing of any gains or losses related to acquisitions & dispositions, the timing and magnitude of the financial impact related to the mark-to-market of our investment in BETA Technologies, Inc. and the timing and magnitude of restructuring expenses. Although we have attempted to estimate the amount of gains and restructuring charges for the purpose of explaining the probable significance of these components, this calculation involves a number of unknown variables, resulting in a GAAP range that we believe is too large and variable to be meaningful.

2026 GUIDANCE: 2026 FCF (NON-GAAP)

We cannot provide a reconciliation of the differences between the non-GAAP expectations and corresponding GAAP measure for free cash flow* in 2026 without unreasonable effort due to the uncertainty of timing for capital expenditures and restructuring related cash expenditures.

Caution Concerning Forward Looking Statements:

This release and certain of our public communications and filings we make with the U.S. Securities and Exchange Commission (SEC) may contain statements related to future, not past, events. These forward-looking statements often address our expected future business and financial performance and financial condition, and often contain words such as "expect," "anticipate," "intend," "plan," "believe," "seek," "see," "will," "would," "estimate," "forecast," "target," "preliminary," "range" or similar expressions. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the impacts of macroeconomic and market conditions and volatility on our business operations, financial results and financial position; conditions affecting the aerospace and defense industry, including our customers and suppliers; our expected financial performance, including cash flows, revenue, margins, net income and earnings per share; planned and potential transactions; our credit ratings and outlooks; our funding and liquidity; our cost structures and plans to reduce costs; restructuring, impairment or other financial charges; or tax rates.

For us, particular areas where risks or uncertainties could cause our actual results to be materially different than those expressed in our forward-looking statements include:

- changes in macroeconomic and market conditions and market volatility (including risks related to recession, inflation, supply chain constraints or disruptions, interest rates, values of financial assets, oil, jet fuel and other commodity prices and exchange rates), and the impact of such changes and volatility on our business operations and financial results;

- market or other developments that may affect demand or the financial strength and performance of airframers, airlines, suppliers and other key aerospace and defense industry participants, such as demand for air travel, supply chain or other production constraints, shifts in U.S. or foreign government defense programs and other industry dynamics;

- pricing, cost, volume and the timing of sales, deliveries, investment and production by us and our customers, suppliers or other industry participants;

- the impact of actual or potential safety or quality issues or failures of our products or third-party products with which our products are integrated, including design, production, performance, durability or other issues, and related costs and reputational effects;

- operational execution on our business plans, including our performance amidst market growth and ramping newer product platforms, meeting delivery and other contractual obligations, improving turnaround times in our services businesses and reducing costs over time;

- global economic trends, competition and geopolitical risks, including evolving impacts from tariffs, sanctions or other trade tensions between the U.S. and other countries or demand or supply shocks from events such as a major terrorist attack, war, natural disasters or actual or threatened public health pandemics or other emergencies;

- the amount and timing of our income and cash flows, which may be impacted by macroeconomic, customer, supplier, competitive, contractual, financial or accounting (including changes in estimates) and other dynamics and conditions;

- our capital allocation plans, including the timing and amount of dividends, share repurchases, acquisitions, organic investments and other priorities;

- our decisions about investments in research and development or new products, services and platforms, and our ability to launch new products in a cost-effective manner, as well as technology developments and other dynamics that could shift the demand or competitive landscape for our products and services;

- our success in executing planned and potential transactions, including the timing for such transactions, the ability to satisfy regulatory requirements or any applicable pre-conditions and the expected benefits;

- downgrades of our credit ratings or ratings outlooks, or changes in rating application or methodology, and the related impact on our funding profile, costs, liquidity and competitive position;

- capital or liquidity needs associated with our run-off insurance operations or mortgage portfolio in Poland (Bank BPH), the amount and timing of any required future capital contributions and any strategic options that we may consider;

- changes in law, regulation or policy that may affect our businesses, such as trade policy and tariffs; government defense priorities or budgets; environmental or climate regulation, incentives and emissions offsetting or trading regimes and the effects of tax law changes or audits;

- the impact of regulation; government investigations; regulatory, commercial and legal proceedings or disputes; environmental, health and safety matters; or other legal compliance risks, including the impact of shareholder and related lawsuits, Bank BPH and other proceedings that are described in our SEC filings;

- the impact related to information technology, cybersecurity or data security breaches at GE Aerospace or third parties; and

- the other factors that are described in the "Risk Factors" section in our Annual Report on Form 10-K for the year ended December 31, 2024, as such descriptions may be updated or amended by the factors that will be included in our Annual Report on Form 10-K for the year ended December 31, 2025 and in future reports we file with the SEC.

These or other uncertainties may cause our actual future results to be materially different than those expressed in our forward-looking statements. We do not undertake to update our forward-looking statements. This document includes certain forward-looking projected financial information that is based on current estimates and forecasts. Actual results could differ materially.

Additional Information

CFM International is a 50/50 JV that produces CFM56 and LEAP engine families. RISE is a program of CFM International. CFM RISE is a registered trademark. CFM RISE is a technology demonstrator program, not a product for sale. Engine Alliance is a 50/50 JV that produces the GP7200 engine.

GE Aerospace’s Investor Relations website at www.geaerospace.com/investor-relations, as well as GE Aerospace’s LinkedIn and other social media accounts, contain a significant amount of information about GE Aerospace, including financial and other information for investors. GE Aerospace encourages investors to visit these websites from time to time, as information is updated and new information is posted.

Additional financial information can be found on the Company’s website at: www.geaerospace.com/investor-relations under Events and Reports.

Conference Call and Webcast

GE Aerospace will discuss its results during its investor conference call today starting at 7:30 a.m. ET. The conference call will be broadcast live via webcast, and the webcast and accompanying slide presentation containing financial information can be accessed by visiting the Events and Reports page on GE Aerospace’s website at: www.geaerospace.com/investor-relations. An archived version of the webcast will be available on the website after the call.

About GE Aerospace

GE Aerospace is a global aerospace propulsion, services, and systems leader with an installed base of approximately 50,000 commercial and 30,000 military aircraft engines. With a global team of approximately 57,000 employees building on more than a century of innovation and learning, GE Aerospace is committed to inventing the future of flight, lifting people up, and bringing them home safely. Learn more about how GE Aerospace and its partners are defining flight for today, tomorrow and the future at www.geaerospace.com.