We’re excited to host GE Aerospace’s Investor Update and 2Q'25 earnings webcast this morning at 7:30AM EDT. Chairman and CEO Larry Culp and CFO Rahul Ghai will share highlights from the quarter as well as updates to our financial outlook and strategic priorities. You can find the webcast and presentation on our Investor Relations website.

GE Aerospace Chairman and CEO H. Lawrence Culp, Jr., said, “The GE Aerospace team delivered an excellent second quarter with free cash flow nearly doubling and more than 20% growth in orders, revenue, operating profit, and EPS. We are raising our 2025 guidance and 2028 outlook, with our operating performance and robust commercial services outlook underpinning our higher revenue, earnings, and cash growth expectations. Our team is using FLIGHT DECK to improve safety, quality, delivery and cost—always in that order—as we strive to provide unrivaled customer service and deliver on our roughly $175 billion backlog."

Looking at our 2Q'25 results, GE Aerospace reported an excellent quarter, with >20% growth all key metrics. Orders were up 27% and adjusted revenue* was up 23%. Commercial services was particularly strong, with 28% growth in orders and 29% growth in revenue. This supported operating profit* growing 23%, operating profit margin* reaching 23.0% and adjusted EPS* growth of 38%. Free cash flow* of $2.1B nearly doubled year-over-year.

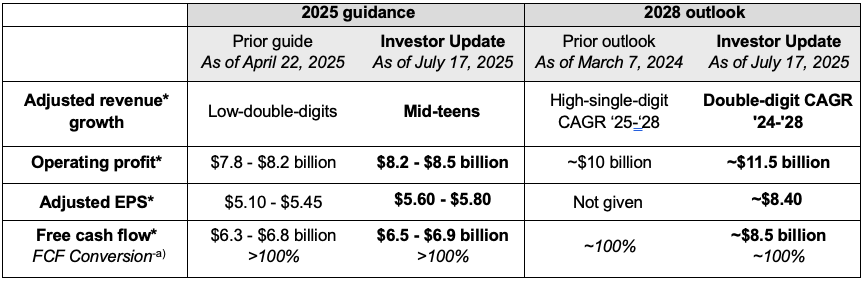

On the call, we will provide more insight on our raised 2025 guidance and 2028 outlook, which includes achieving ~$11.5 billion of operating profit* and ~$8.5 billion of free cash flow* in 2028, both up $1.5 billion versus our prior outlook. This represents over $3B of operating profit* growth versus our updated 2025 outlook, with margins expanding to over 21%, driven by strength in Commercial services. We will also discuss our services growth trajectory, engine durability improvements, and future of flight advancements in both commercial and defense.

We also announced our plans to increase capital returns to shareholders from 2024 to 2026 by 20% to approximately $24 billion, including a $19 billion share buyback authorization, subject to Board approval.

We welcome any feedback on today’s event. Thank you for your interest in GE Aerospace.

GE Aerospace Investor Relations

* Non-GAAP Financial Measure; For important information about forward-looking statements, please see here.

(a- FCF* conversion: FCF*/adjusted net income*