GE Aerospace released its fourth quarter and full year 2025 financial results today along with guidance for 2026. We encourage you to read the full materials and listen to our earnings call at 7:30 AM EDT.

Key highlights of GE Aerospace's performance for the fourth quarter:

- Total orders of $27.0B, +74%

- Total revenue (GAAP) of $12.7B, +18%; adjusted revenue* $11.9B, +20%

- Profit (GAAP) of $2.9B, +24%; operating profit* $2.3B, +14%

- Profit margin (GAAP) of 22.4%, +120 bps; operating profit margin* 19.2%, (90) bps

- Continuing EPS (GAAP) of $2.31, +32%; adjusted EPS* $1.57, +19%

- Cash from Operating Activities (GAAP) of $2.1B, +59%; free cash flow* $1.8B, +15%

Key highlights of GE Aerospace's performance for the full year 2025:

- Total orders of $66.2B, +32%

- Total revenue (GAAP) of $45.9B, +18%; adjusted revenue* $42.3, +21%

- Profit (GAAP) of $10.0B, +31%; operating profit* $9.1B, +25%

- Profit margin (GAAP) of 21.8%, +210 bps; operating profit margin* 21.4% +70 bps

- Continuing EPS (GAAP) of $8.05, +32%; adjusted EPS* $6.37, +38%

- Cash from Operating Activities (GAAP) of $8.5B, +47%; free cash flow* $7.7B, +24%

GE Aerospace Chairman and CEO H. Lawrence Culp, Jr., said, “With a strong fourth quarter, GE Aerospace delivered an outstanding year as revenue grew 21%, EPS was up 38%, and free cash flow conversion exceeded 100%. Our performance demonstrates how FLIGHT DECK is taking hold as we accelerated services and equipment output to fulfill our growing backlog of roughly $190 billion."

Culp continued, "We enter 2026 with solid momentum to build upon these results and are well positioned to create greater value for our customers. This supports another year of substantial EPS and cash growth, and I'm confident our team will deliver."

In the fourth quarter, Commercial Engines & Services (CES) delivered robust performance with total orders up 76%, including services increasing 18% and equipment more than doubling. Revenue was up 24%. Services grew 31% with internal shop visit revenue up 30% and spare parts revenue up more than 25%. Equipment revenue grew 7%, with unit volume up 40%, more than offsetting a year-over-year decline in the spare engine ratio. Operating profit of $2.3 billion was up 5%.

In Defense & Propulsion Technologies (DPT), orders increased 61%, and revenue was up 13% with Defense & Systems up 2% and Propulsion & Additive Technologies up 33%. Operating profit increased 5% to $0.3B.

Our performance in 2025 demonstrates how FLIGHT DECK is taking hold, driving incremental gains that compounded into meaningful operational improvements. This enabled us to accelerate services and equipment output to deliver on our roughly $190 billion backlog. Our Technology & Operations (T&O) team delivered meaningful impact leveraging FLIGHT DECK throughout its first year, and as a result, material input from our priority suppliers increased greater 40% year-over-year. This supported 2025 CES services revenue +26% and engine deliveries increasing 25%, including LEAP exceeding 1,800 units - record output for the program.

Additionally, last week, we shared that we’re integrating the CES and T&O teams into one organization, led by Mohamed Ali to further accelerate progress in 2026. And, we’re elevating our customer facing teams to report directly to Larry, aligned with our focus on being customer-driven. These organizational changes will further enable cross-functional problem solving, agility and alignment to deliver for our customers.

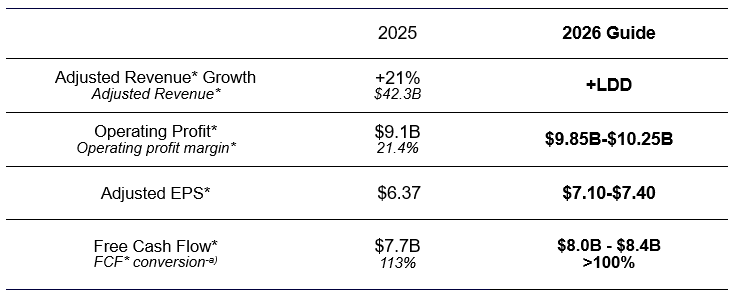

Based on GE Aerospace's performance and trajectory entering 2026, we are initiating the following total company guidance:

Thank you for your continued interest in GE Aerospace,

GE Aerospace Investor Relations team

*Non-GAAP Financial Measure; For important information about forward-looking statements, please see here.